The Best Money Savings Apps you should use in 2023

Want to make saving money less of a chore? Read our review of the top money savings apps that can help you save more.

For many of us, improving our financial situation usually makes it onto our list of new years resolutions - before quickly falling by the wayside. In this article, we're looking at the apps on the market that can help you stick to your new year's resolutions.

Become a Host

Join thousands of Stashbee Hosts, start earning now

Become a HostHow Do Money Saving Apps Work?

A quick look through the App store for money saving apps may leave your head spinning.Apps for budgeting, banking, sending and receiving money. There's also voucher apps, discount apps, and even apps that round up your spending and put money into a savings pot for you.

In this list, we've focused on any money apps that meet one very simple criteria: helping you save passively. Basically, allowing you to save without lifting a finger.

A disclaimer before we dive in: none of these apps are able to magically change your spending habits, you'll need to do that part yourself. But they CAN help you with your spending and saving goals, and teach you about personal finance along the way

Here a best money savings apps UK to use in 2023:

Revolut - Best all rounder

Revolut is a super convenient banking app that helps you save money on everyday expenses like foreign transactions, ATM withdrawals and currency exchange. They call themselves a "financial assistant in your pocket".

With Revolut, you can manage your money, track your spending and set budgets. You also get real-time exchange rates for foreign currencies, which can be handy if you travel often or make regular international payments. The interest rate they provide is pretty competitive.

One of the best things about Revolut is that it's super user-friendly. The app is easy to navigate and understand, so you don't have to be a finance expert to use it. If you ever need help or have a question, Revolut's customer support team is (usually) ready to assist you.

Here's a more detailed breakdown of what each Revolut's pricing tier provides:

| Tier | Price | Feature |

| Free | £0/month | Free debit card |

| Real-time exchange rates | ||

| Free ATM withdrawals up to £200/month | ||

| Free foreign transactions | ||

| Budgeting and tracking | ||

| Plus | £2.99/month | Everything from the free account |

| Free ATM withdrawals up to £400/month | ||

| Travel insurance (Delays, cancellations and lost luggage) | ||

| Priority customer support | ||

| Disposable virtual cards | ||

| Premium | £6.99/month | Everything from the Plus account |

| Free ATM withdrawals up to £600/month | ||

| Global express delivery on replacement cards | ||

| Free lounge passes | ||

| Revolut Junior account | ||

| Premium customer support | ||

| Metal | £12.99/month | Everything from the Premium account |

| Free ATM withdrawals up to £800/month | ||

| Cashback on all card transactions | ||

| Free airport lounge access | ||

| Concierge service | ||

| Metal contactless card |

It's not all perfect of course, there are some downsides to consider. Some regulators have raised concerns about the company's compliance with anti-money laundering regulations. Some users have reported slow customer service response times, and there have been some issues with card payments being declined without explanation.

Whilst there are plenty of online banks to choose from, on our view Revolut is a great option for anyone looking for a convenient and easy to use way to manage their money and save some along the way.

Related

How to Make Extra Money from Home During the Holiday Season

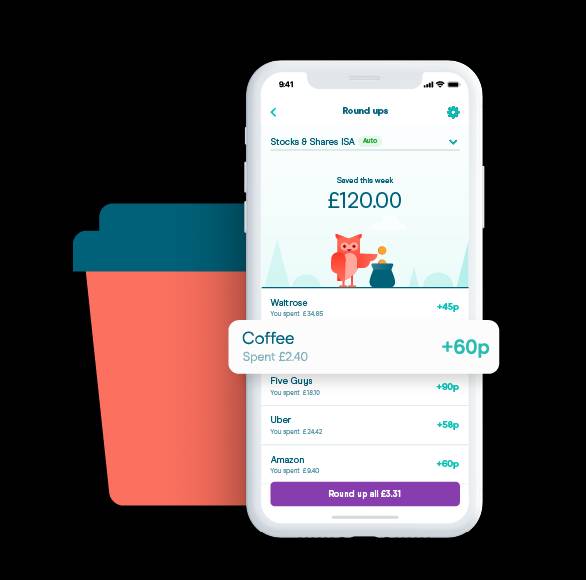

Moneybox: Best for Beginners

Moneybox is a savings and investment app that helps users save and invest small amounts of money easily and regularly. The app offers lots of different investment options, like ISAs and General Investment Accounts.

The app is well known for it's round-up feature. Every time you spend, it rounds up to the nearest pound, then puts the extra cash in a virtual piggy bank for you.

Here's a breakdown of what the Moneybox app offers:

| Feature | Description |

| Investment options | ISAs, Lifetime ISAs, and General Investment Accounts |

| Round-up feature | Round up your purchases to the nearest pound and save the difference automatically. |

| Regular contributions | Set up regular contributions to your investment account |

| Low minimum investment | Start investing with as little as £1 |

| Educational resources | Provide users with educational resources and guides to help them understand the investment options available. |

Moneybox has different pricing tiers, but the basic account is free and include features like:

- Investment options

- Round-up feature

- Regular contributions

- Low minimum investment

Some cons: The app only has a limited range of investment options, and the returns on investments may be lower than other options out there. Some users have reported that the app can be slow to load, and customer support can be a bit slow to reply.

Related

4 Ways to Save Money on Your Commute to Work

Plum: Best for Investing

Plum is an AI-powered savings app that helps users save money automatically. The app uses machine learning to analyze users' spending habits and automatically sets aside small amounts of money into a savings account. Users can set savings goals and track their progress towards those goals. The app also offers a range of investment options such as ISAs, which allow users to invest in a diversified portfolio of stocks and shares.

Here's a breakdown of what Plum offers:

| Feature | Description |

| AI-powered savings | Automatically sets aside small amounts of money into a savings account based on your spending habits |

| Investment options | ISAs and other investment options that allow users to invest in a diversified portfolio of stocks and shares |

| Goals setting | Users can set savings goals and track their progress towards those goals |

| Automated savings | Automatically save for your goals without thinking about it. |

Plum is free, and allows you connect your bank account to the app and start saving and investing automatically. However, there are some potential drawbacks to consider. Some users have reported that the app can be slow to load, and not everyone is comfortable relying on artificial intelligence for investment advice.

Honey: Best for Deals

Honey isn't actually a mobile phone app - it's a browser extension! It helps users save money by automatically finding and applying coupons and deals to their online shopping cart. The extension works with a wide range of popular online retailers, including Amazon, Target, and Best Buy. It also offers a price tracking feature that alerts users when the price of an item drops.Here's a breakdown of what Honey offers:

| Feature | Description |

| Automatic coupon finding | Automatically finds and applies coupons to your online shopping cart |

| Price tracking | Alerts users when the price of an item drops |

| Wide range of retailers | Works with a wide range of popular online retailers, including Amazon, Target, and Best Buy |

Honey is a free browser extension that can be installed on Chrome, Safari, Firefox, Edge, and Opera. On average, it can save you around £95 a year, with a 18% average discount, and it works on 30,000+ companies’ websites

It's important to remember that it may not always find the best deal or offer. Some users have said that the extension can slow down their browser, too.

Related

How to Make Money on Maternity Leave

Other Ways to Save Money

Apps are of course not the only way. Here are some no-brainer tips on how to spend less and save money.i. Keep an eye on your transactions.

Small costs often slip under the radar, and add up. Check you outgoings regularly, and use your banking app's "filter by" functionality to group spends into logical buckets and see where you might want to cut back a bit.ii. Remember what you spend on.

Make a mental note of where you usually go for your most regular expenditures like groceries, and compare the prices with other retailers. The chicken might be cheap at Lidl, but the pasta could be cheapest at Sainsbury’s. Spend smarter, not lazier!iii. Budget your savings.

You may want to follow the 50, 30, 20 rule. Spend 50% of your income on the basics (like rent, taxes and food), 30% on "nice to haves" and save the other 20%.iv. Set boundaries.

Spending on food, drink and going out can really add up. Limiting yourself to eight coffees a month instead of twenty will save you lots of money in the long run. Cooking dinners at home rather than using Deliveroo, and using public transport instead of taxis are also useful tactics.v. Shop second hand.

The UK benefits from thousands of wonderful charity shops that contain hidden treasures for low prices. Instead of going to a high street store to buy a brand new £40 t-shirt, why not check out a charity shop first? There are tonnes of apps that allow you to shop second hand too, like Depop.vi. Go through your subscriptions.

Most of us have a few different streaming, music and food subscriptions. Ask yourself, do I really make the most of these? It's a good habit to go through your bank statement from time to time and unsubscribe from any subscriptions that you're not using much.vii. Allow yourself to spend.

This might seem counterintuitive, but saving is a lot like a diet. If you don't allow cheat days, you may break out of the habit. It's good to spend a little bit for things that make you happy!Once you've found the right money saving app for you, there are also a tonne of ways to make passive income. Try our Rent-to-earn Calculator to see how much you could make from items you've got lying around the house. If you've got a spare garage or parking space, check out how easy it is to become a Stashbee Host and earn passive income.

Become a Host

Join thousands of Stashbee Hosts, start earning now

Become a HostAnthony

Written 13th Apr 2023